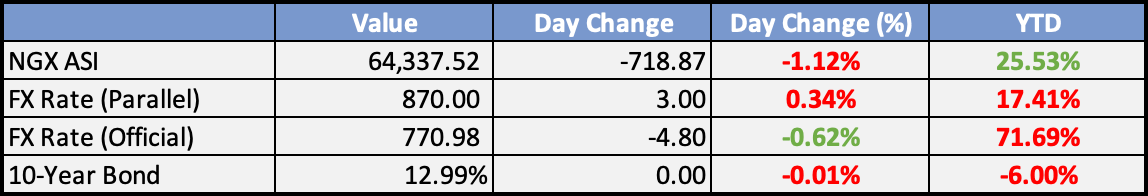

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Multiple Chinese property stocks rose Monday on optimism about Beijing’s latest efforts to boost housing demand and improve developers’ finances.

Official manufacturing PMI was 49.3 in July, almost in line with the consensus of 49.2.

China Beige Book survey that showed almost every major sector saw a weakening in both revenue and profit margin compared with June as consumers cut back on spending on everything but travel and restaurants.

China issues 20 measures to boost consumption but stops short of direct consumer support

Japan industrial production, retail sales finish Q2 higher - Industrial production rose 2.0% m/m in June, compared to consensus 2.4%, rebounding from a -2.2% drop in the previous month. Retail sales fell -0.4% m/m vs expected -0.7% decline, following a 1.4% rise in May.

RBA’s 1-Aug policy decision is likely to be a close call with views mixed on whether it will raise the cash rate by 25 bp to 4.35% or leave it unchanged for a second month

Chinese firms are seeking Korean partners to skirt US EV rules

Europe, Middle East, Africa

Q2 Eurozone preliminary GDP +0.3% QoQ vs consensus +0.2% and prior 0.0% while on an annualized basis, preliminary GDP +0.6% YoY vs consensus +0.5% and prior +1.1%

Eurozone inflation fell in line with expectations to 5.3% in July down from 5.5% in June. Core inflation remains unchanged at 5.5%.

German retail sales post first monthly decline since March. Sales for June declined 0.8% MoM vs expectations of +0.2% and upwardly revised 1.9% prior.

The Americas

Trucking firm Yellow shuts down operations ahead of an expected bankruptcy filing

Walmart spends $1.4B on buying the remaining stake in Flipkart

Shipping industry vulnerable to downturn amid record $90B spent on new ship orders by giants

Better breadth with nearly 90% of S&P 500 members above their 50-DMAs late in July. Pain trade is still higher with a record ~$5.5T in money-market mutual funds and still-light positioning in key cyclical pockets.

The Week Ahead:

Monday:

Large Retailer Sales (Japan)

NBS Manufacturing PMI (China)

Chicago Purchasing Managers Index (US)

Tuesday:

Unemployment Rate (Japan)

Caixin Manufacturing PMI (China)

Unemployment Rate (EA)

S&P Global Manufacturing PMI (Canada)

ISM Manufacturing PMI (US)

Wednesday:

BOJ Monetary Policy Meeting Minutes (Japan)

ADP Employment Change (US)

Thursday:

Producer Price Index (EA)

Bank of England Minutes (United Kingdom)

BoE Governor Bailey Speech (United Kingdom)

Initial Jobless Claims (US)

S&P Global Composite PMI (US)

ISM Services PMI (US)

Friday:

Retail Sales (EA)

Average Hourly Earnings (US)

Ivey Purchasing Managers Index (Canada)

Investment Tip of The Day

Stay updated on geopolitical developments, global trade agreements, and currency fluctuations to understand their potential impact on international investments. Assess the risks and opportunities associated with investing in foreign markets and consider currency hedging strategies to manage currency risk.

Meme of the Day